BITO 0.00%↑ is NOT a typical dividend stock, if you invest in it for the dividend without understanding it, you WILL lose money !

If you invested in BITO after seeing the 76% dividend yield, I highly recommend that you finish reading this article.

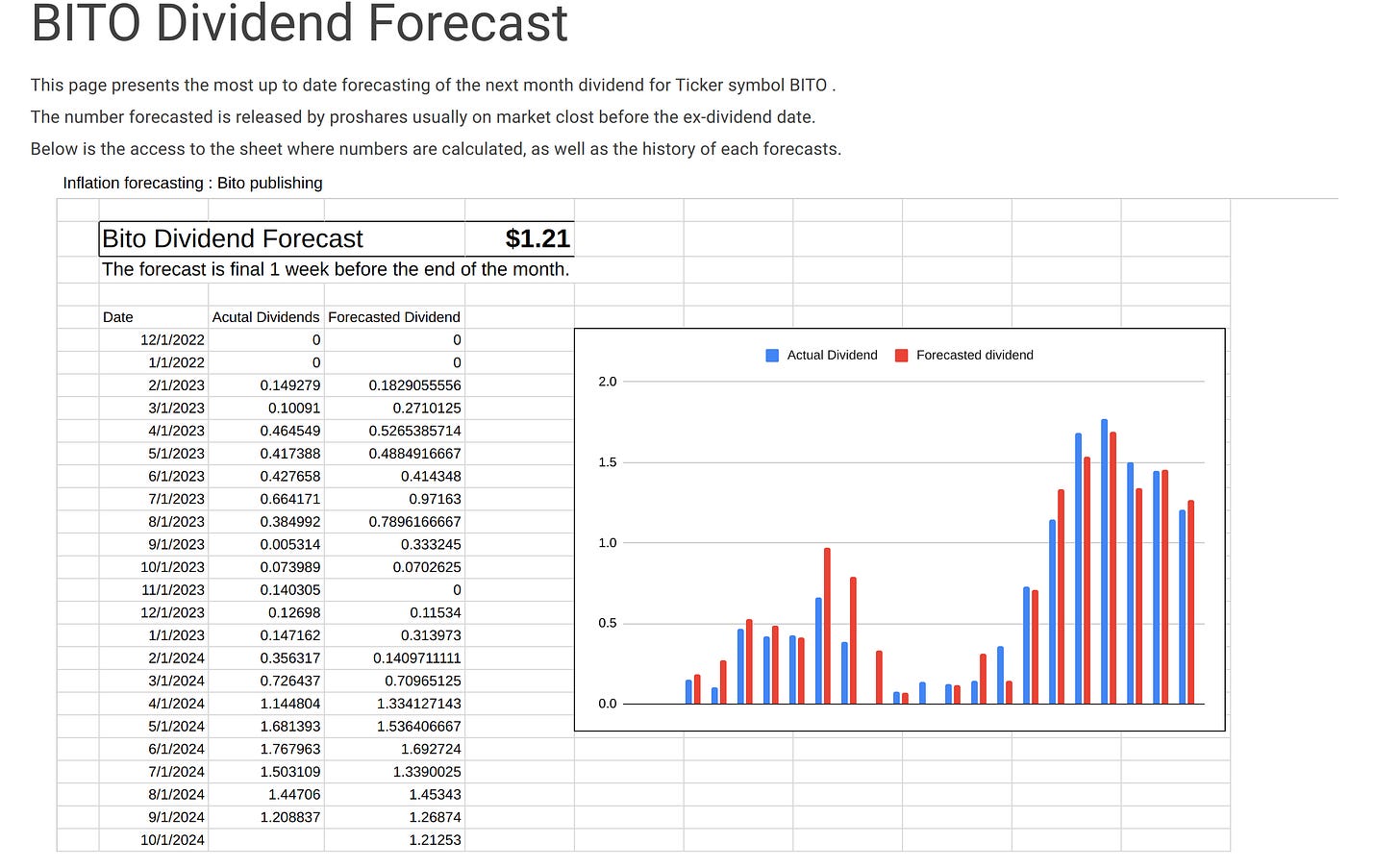

If you don’t want to read this article full of hard learned knowledge shared for free and are just interested in next dividend forecast go here.

What is BITO and how does it work ?

BITO is a fund aiming to replicate bitcoin returns, but without directly owning bitcoins.

It does so by buying 1 month forward contract of bitcoin on CME. This means that at the end of the month they sell the contracts they had from the previous month, and buy contracts of BTC for the next month.

Simply put: if BTC goes up, BITO goes up.

About 1 week before the end of the previous contracts they progressively roll contracts to new ones.

On the 20th they already rolled 25% of September contracts into October contracts.

They used to hold 2 month contracts, at about 50% current month, and 50% 2 month forward but have switched to one month contract since July 2024. There was no explanation as to why they did this change. But I believe this makes it simpler for investors to understand BITO dividends.

Is it efficient ?

Short answer is no. But let’s see the numbers.

Rolling CME contracts has a cost.

It comes from what we call “Contango”. Because the price is expected to go up during the month, the futures price is higher than its current price. It means that there is a cost to always buy contracts instead of bitcoin.

On Friday 20th (the day the first contracts are rolled) the cost was $540 or 0.86% over bitcoin current price.

Note that the closer we are to the end of the contract, the smaller is the gap. So when selling the contracts back, this premium is much smaller and so the premium paid for the contract is lost. This is similar to the time value of an option.

This gap changes every month and has even, though rarely, been in “backwardation” meaning cheaper the price of the underlying.

But on average it is MORE expensive to roll contracts than to hold BTC

At 0.86% each month, the cost is about 10% per year !

On the holding page, you can notice that there is a big amount of treasury bills.

These are the collateral necessary for the fund to be able to execute on the contracts they hold. Even though they never plan on executing these contracts, these treasury bills are required.

Fortunately they do return some money and with recent higher interest rates they return 4 to 5% per year. This compensates a bit for the contract rolling costs.

But in the end after counting the additional expense ratio of 1%, the cost of holding BITO instead of BTC is about 7% per year !

Why is BITO giving Dividends ?

The reason BITO gives dividends has to do with his special tax structure.

Based in cayman islands, the fund has to distribute nearly all profits to avoid paying taxes on the product they provide.

It means that the underlying price of the fund CANNOT go up fiscal Year over Year. (This statement is not completely true because of other reasons I’ll describe last section but it’s simpler to think of the fund this way)

Where are dividend coming from ?

The fiscal year of BITO ends on September 30th. So on this date all the profits made during the year should have been distributed to stockholders.

And if BITO did not incur losses, the price of BITO should be roughly the same as it was on September 30th from the previous year.

If there were losses by September 30th, losses are not carried on towards the new year. And the BITO price gets “fixed” at this new price, and should return at this new price by the end of next fiscal year.

What that means is: in the long term BITO price can go down, but can’t go up !

And given BTC volatility, it’s a given that BITO price will eventually drop.

Before diving into how the profits are distributed you should have understood that: 100% of the dividend comes from BTC price change.

This is not a strategic fund generating income by selling options on volatility, so it CANNOT overperform Bitcoin.

How are dividends calculated ?

During the fiscal year, if the fund is at a loss ( this can be seen by having BITO price being lower than it was on September 30th of the same year), then the profits of next months will go towards canceling the losses. And no dividend will be paid.

Simply put: BITO today < BITO on Sept 30th = NO DIVIDEND

If BITO is above the September 30th price, it means that BTC went up, and upon the rolling of contract to next month contract, the fund will have to realize the profits.

For example if BTC went up 10% in one month, there will be a 10% profit in the BITO fund that will need to be distributed to fund holders.

This profit will be distributed over the WHOLE fiscal year. One month of gain will not be entirely distributed at the next dividend date.

This makes sense, otherwise every down month would push BITO lower and lower and force the fund to do multiple reverse splits.

Instead the current profit is divided by the number of remaining months until the end of the fiscal year and given as a dividend.

For example if BITO was flat from September to December 30th at $17.5 and suddenly went to $20 by the end of January. The $2.5 of “profit” due to BTC going up, must now be distributed before Sept 30th. There are 9 distributions left, so the dividend on Feb 1st will be 2.5/9 = $0.28

If Bitcoin stays flat the next month, BITO price will now be $19.72 (20 - 0.28) on feb 1st, and if the price remains the same by end of month, March 1st dividend will also be $0.28 and BITO price will be $19.44 (19.72 - 0.28)

This will repeat until all of the profit is distributed as dividend.

If in April BTC price moves back to what it was before the dividend distribution, BITO will be $16.94 . It will now have pending losses and will stop distributing dividends.

Just to make it clear, let’s repeat the example but use April instead of December.

In May BITO price is $20 and we have $2.5 of profit to distribute. There are 5 months left so the dividend on June 1st will be 2.5/5 = $0.5 and BITO price on June 1st will be $19.5

For simplicity, I have created a modeling for forecasting the dividend that you can find here:

https://financialtoolsbuilder.com/bitoforecast

Data is final usually on the 24th, but until then, you can see the closest approximation of the dividend.

Why you SHOULDN’T hold BITO ?

So if you followed until here, you should understand that you will underperform bitcoin by holding BITO !

It’s even worse if you are investing in a taxable account. Even if you make almost the same gains with BITO and BTC over a one year period, because the profits are realized each month, the capital gains will be taxed short term instead of long term !

And if you are not in the US, the 30% tax on dividends at the source will also mean that you can’t get the full compounding effect through reinvesting.

If you want to profit from bitcoin price appreciation, buy it directly, hold it in a cold wallet, or if you have no other choice get one of the BTC ETF like BITB 0.00%↑

Why you SHOULD hold BITO ?

The only reason to use BITO is to generate extra return using options.

Today bitcoin ETF do not have yet options, so a very convenient way to place options on bitcoin is through this BITO fund.

Buying and selling calls or puts is a great way to generate cash, and doing it on a volatile asset like bitcoin can be life changing.

But you should already realize that the options will not be easy to price.

Do you really understand BITO options ?

If you answered yes, I don’t believe you ! I also don’t understand all the complexities !

What does all this dividend shenanigan imply for the option market ?

BITO options are MUCH more complex than regular options !

For example what does a $20 strike for June 30th mean ?

Let’s say that the price on September 30th 2024 is $17.5, does a $20 strike mean a 14.2% move up ? Not really.

There are different ways to reach $20 it can be with a 14.2% move during the month of June. But it can also be a move to $25 earlier in the year that went back to $20 by giving the dividends.

Remember the price of BITO needs to be back at $17.5 by September !

So the closer you get to October 1st, the bigger the upside moves will be directly linked to an increased dividend, and a drop in BITO price.

So to profit from buying call options, you not only need to be right on the direction of BTC but also on WHEN bitcoin will go up. If bitcoin goes up early in the fiscal year, the price of BITO will drop due to the distributions, and depending on how close you are to the end of year, the distribution will contain more of the price increase.

Can you still profit from BITO options ? Yes, definitely. With complexity comes opportunity.

Sometimes the option market is incorrectly forecasting the dividend, in this case you can either buy or sell options to arbitrage the gap.

And even when the dividend is correctly priced in for the next month, you can have a “regular” approach to selling covered calls to collect premiums.

But keep in mind that for multi month or leap options the “bet” you are making is not just up or down. The fact that it gives dividends at a different rate when it goes up, but stops giving dividends when it’s down, makes the Implied Volatility (as well as all other greeks) shown of the options completely wrong.

I’m not sharing here the strategies I use with BITO because it is not the aim of this post and will share them later. But if modeled BITO dividend to forecast it, there is a reason ;)

Anything else to know ?

Now that you think you understand how the dividends are calculated, let’s add couple of unknown factors to the mix.

The dividends are calculated 6th days before the end of the month. Maybe using closing price, or maybe using after market hour price.

This 6 days period between dividend calculation and ex-dividend date can usually be ignored, but matters when across fiscal years.

The exact “anchor” price from September 30th is unknown.

The management can change the dividend distributions at their will.

The rollout of contracts to next month is not deterministic, so profit will or will not be realized depending on how many contracts are already rolled when a price move occurs.

The creation and redemption of shares of the fund can force early realization of profits or losses. It can also move the anchor price or the amount of dividend per share.

This extra complexity is hopefully small, but is also why we can’t have an ‘exact’ forecast of the BITO dividend.

Approximations are enough to profit if you are the closest one though.

The forecasting model I’ve created (referred above) has been pretty accurate so far and has a R²= 0.918.

Thank you for reading, please share if you learned something !

BITO closed on 9/30/23 at 13.81 and closed on 9/30/24 at 19.01- was there something different last year that allowed BITO to close at a higher price at fiscal year end last year and will preclude that from happening this year?